Well Accounted For Business Services Encourages Taxpayers to Choose Authorized, Secure Tax Preparers

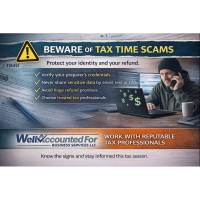

As tax season approaches, Well Accounted For Business Services is urging individuals and small business owners to take extra care when choosing who prepares their taxes and handles their personal financial information.

While many people rely on referrals or long-standing habits, experience alone does not guarantee legitimacy. Authorized tax preparers are required to maintain professional credentials, complete ongoing education, and use secure, professional tax software to stay compliant with IRS regulations and data-security standards.

Well Accounted For Business Services advises taxpayers to do their homework before sharing sensitive information. This includes checking verified reviews, confirming professional credentials such as PTIN, EA, or CPA status, and ensuring the preparer follows strict data-security practices comparable to HIPAA-level privacy protections.

One of the biggest risks during tax season is improper handling of personal information. Social Security numbers, W-2s, identification documents, and financial records should never be shared through email, text messages, or social media platforms. Reputable tax professionals use secure portals or encrypted upload systems designed to protect client data.

Consumers are also encouraged to be cautious of so-called “free estimates” or promises of large refunds before documentation is reviewed. These practices are often red flags that indicate a lack of professional standards or potential fraud.

Well Accounted For Business Services emphasizes that a legitimate tax professional will protect client data, clearly explain tax filings, and stand behind their work. Choosing the right preparer is not just about convenience. It is about protecting identity, finances, and long-term peace of mind.

Well Accounted For Business Services LLC

-

Jennifer Mills LLC Member

- January 28, 2026

- (573) 854-9036

- Send Email